In the ever-evolving landscape of business finance, understanding the ins and outs of this crucial subject is essential for success. Whether you’re a seasoned entrepreneur or just starting out, grasping the intricacies of business finance is vital to making informed decisions and ensuring steady growth. From managing cash flow and maximizing profits to navigating the complex world of business tax laws, this comprehensive guide will unveil the secrets behind achieving financial success in the ever-competitive business realm. So, prepare to uncover the key strategies and expert insights that will empower you to unlock the full potential of your business finance endeavors. Let’s embark on this enlightening journey together, as we demystify the world of business finance and set the stage for a prosperous future.

Understanding Business Finance

In order to succeed in the world of business, understanding the intricacies of finance is essential. Business finance encompasses the management and utilization of funds to achieve company objectives and maximize profitability. By acquiring a comprehensive understanding of business finance, entrepreneurs can make informed decisions that lead to long-term success.

One crucial aspect of business finance is budgeting. A well-planned budget serves as a roadmap for the allocation of financial resources. It helps business owners determine how much they can spend on various expenses and investments, ensuring that money is utilized in the most effective and efficient way possible.

Another key component of business finance is cash flow management. Cash flow refers to the movement of money into and out of a business. Monitoring and maintaining a healthy cash flow is vital to the survival and growth of any company. By effectively managing cash flow, businesses can ensure that they have sufficient funds to cover day-to-day operations and take advantage of growth opportunities.

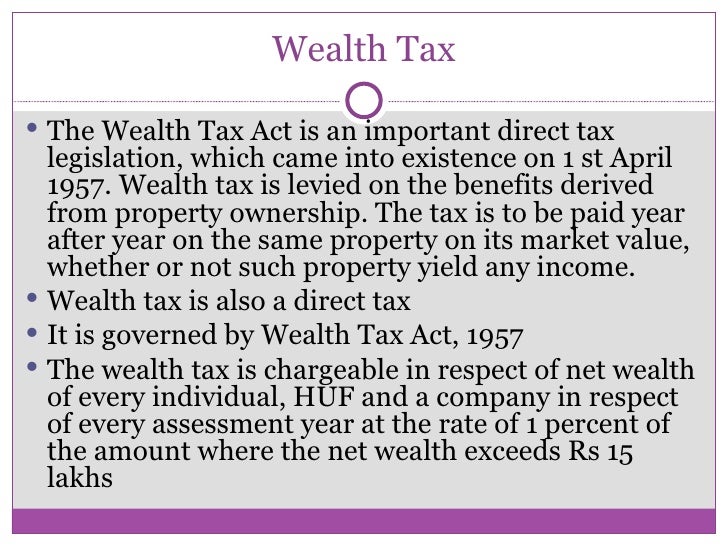

Understanding business tax law is also paramount when it comes to managing finances. Complying with tax regulations and taking advantage of available tax benefits can significantly impact a company’s financial position. By staying informed about tax laws and seeking professional guidance, entrepreneurs can minimize their tax liabilities and enhance their financial success.

As entrepreneurs navigate the complex world of business finance, it is essential to equip themselves with the necessary knowledge and skills. By mastering the fundamentals of budgeting, cash flow management, and business tax law, entrepreneurs can unlock the secrets of business finance and pave the way for success.

Navigating Business Tax Law

Understanding and complying with business tax laws is crucial for the financial success of any company. Complying with tax regulations ensures that you avoid penalties and maintain a good standing with the relevant authorities. In this section, we will explore some strategies that can help you navigate the complex world of business tax law effectively.

One essential step in managing your business taxes is to stay updated with the latest tax regulations and changes. Tax laws can vary from one jurisdiction to another and can also change frequently. By staying informed, you can adapt your tax strategy accordingly and take advantage of any tax breaks or incentives that may be available.

Another key aspect of navigating business tax law is maintaining accurate and organized financial records. Keeping detailed records of all your income, expenses, and financial transactions will not only help you calculate your tax liability accurately but also provide evidence to support your tax deductions and credits. Implementing a robust record-keeping system is essential for smooth tax preparation and filing.

Lastly, it is highly recommended to seek professional assistance when dealing with complex tax matters. Engaging a qualified tax professional or accountant can provide you with expert guidance and ensure compliance with all relevant tax laws. These professionals have the knowledge and expertise to help you optimize your tax liabilities, identify potential risks, and make informed financial decisions that align with tax regulations.

Navigating business tax law may seem daunting at first, but by staying informed, maintaining accurate records, and seeking professional guidance, you can effectively manage your business taxes and create a solid foundation for financial success.

Implementing Successful Strategies

In order to achieve success in business finance, it is crucial to implement effective strategies. These strategies can help businesses navigate the complex world of finance and make informed decisions to drive growth. Here are three key approaches that can lead to a thriving financial foundation:

-

Budgeting and Financial Planning: Developing a comprehensive budget and financial plan is the cornerstone of sound business finance. Businesses should carefully analyze their income, expenses, and cash flow to create a realistic budget that aligns with their goals. By anticipating financial needs and planning for potential risks, businesses can stay on track and make informed financial decisions.

- 831b

Investment and Risk Management: Investing wisely is vital for long-term financial success. Businesses should carefully evaluate potential investment opportunities and diversify their portfolio to manage risk. Additionally, understanding and mitigating financial risks, such as market volatility or unexpected expenses, is crucial in maintaining financial stability.

-

Compliance with Business Tax Law: Adhering to business tax laws is not only critical for avoiding complications and penalties but also contributes to the overall financial health of a company. Staying up-to-date with tax regulations, maintaining accurate financial records, and seeking professional assistance when needed can ensure compliance and create a solid foundation for long-term financial success.

By implementing these strategies, businesses can unlock the secrets of business finance and position themselves for success. With careful planning, informed investment decisions, and compliance with tax laws, businesses can navigate the financial landscape and achieve their desired financial outcomes.